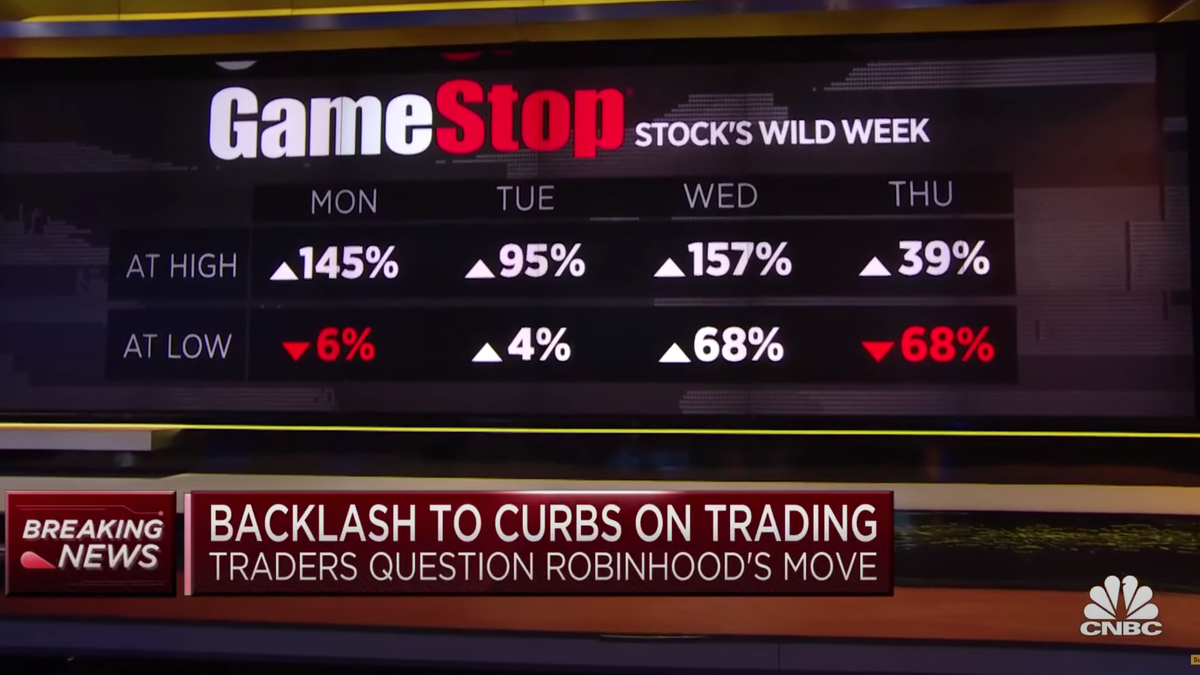

A stock that should’ve been worth close to nothing shot up over a 1000% reaching a peak of over $400. When trading began on the New York Stock Exchange the morning of Wednesday, January 27th, GameStop stock price was already unreasonably high, unchained to any of the company’s fundamentals the beginnings of a short squeeze already underway, but within a half hour of trading, the true depth of the squeeze was unleashed. In the event a company has it’s total floating stock shorted to the extent that GameStop did, if there is sudden new demand for shares increasing price, short-sellers would be forced to bid each other to oblivion fighting to buy shares to cover their wide open short position.

In essence, Reddit had just discovered a nuclear weapon, to level hedge funds to the ground. the hedge funds) are asked to double down or “cover” their short position by buying a required level of their shorted stock to assure their lender of their ability to repay it. Any significant increase in GameStop price this Reddit community observed, would trigger a margin call, a market action where short-sellers (i.e.

Hedge funds had shorted more than 90% of the company’s available floating stock hedge funds got greedy, they did not expect any shenanigans, and were absolutely assured that any movement in the price of stock would only be in one direction. Just after hedge funds shorted GameStop, acute observers and intelligent traders noticed something big. Now, enter the Reddit community of options traders known as r/WallStreetBets. An investor going long only stands to lose the money he initially invested, but a short-seller may borrow a share at a certain price say $100, sell it, and then see the price go up to $500, or a $1,000, or $10,000 with the obligation to repay his loan at that price. However, here’s the catch: unlike investing long where an investor buys a stock with the hope that over time it’s value increases, a short-seller is exposed to infinite risk if his bet turns out to be wrong. As a result he pockets the difference between the price he had borrowed and sold it for compared to the price he bought it at to repay it, thus making $50. The stock’s price falls to $50 as the trader had predicted and so he now buys the stock back but at this lower price, and repays his initial loan with this stock. A trader borrows this stock of a company worth $100 and then immediately sells them. Say the price of a stock is $100, but a trader has reason to believe that it’s price will fall to $50 and wants to profit off of this prediction. Let’s side track shortly, and explore how shorts works.

To profit off of this prediction many of these hedge funds built up something known as a short position against the company, speculating and betting that as it declined, it’s stock prices would dramatically fall, thus allowing them to earn a profit. Wall Street hedge funds, saw through this temporary rally, and based on the fundamentals of the company, predicted that it’s stock prices would eventually fall. In the beginning of January, in an effort to turn-around the corporation, there was a comprehensive change in leadership and management of the company, causing a small boost in investor confidence and optimism in the markets. Let’s start with GameStop, and understand why exactly a declining video game & consumer electronics company, that was losing revenue and market share to the online market, on the verge bankruptcy, is the centre-point of one of the largest rallies in Wall Street history? What does this all mean, and are we witnessing a bottom-up revolution of the everyman against the elite? By pushing up the price of this failing company, they have launched it into the Fortune 500 list, caused multi-billion dollar losses to institutional investors and hedge funds with massive short positions against GameStop, and triggered a short squeeze further driving up the price. The unprecedented rally of GameStop stock over the past 10 days in a buying frenzy orchestrated by retail traders on the social media platform Reddit, particularly r/WallStreetBets (a Reddit community with millions of aggressive day traders) has taken the investing world by storm.

0 kommentar(er)

0 kommentar(er)